The term freight refers to the movement of goods across supply chains using various transportation modes such as trucks, trains, ships, or airplanes. Freight rates are the costs that shippers pay carriers for transporting their products, typically within the truckload (TL) market. These rates are influenced by a wide range of factors, including economic conditions, fleet availability, fuel prices, weight, distance, and the nature of the goods being shipped.

Freight rates are usually negotiated between shippers and carriers either through long-term contracts or on a spot basis. During peak periods like request-for-proposal (RFP) season, companies rely on data from sources like ACT Research and DAT to make informed decisions when submitting bids. This helps them remain competitive in a constantly changing market.

Understanding current freight rate trends is essential for businesses to adapt to market fluctuations and plan effectively. Whether you're managing logistics or making strategic business decisions, staying updated on freight pricing can significantly impact your bottom line.

What Factors Influence Freight Rates?

Beyond the truckload cycle, which we’ll explore further, several key elements affect freight rates. According to Tim Denoyer, an analyst at ACT, “It all comes down to supply and demand.â€

In the TL market, when demand outpaces available capacity—especially when there’s a shortage of drivers or trucks—rates tend to rise. Conversely, if supply grows faster than demand, rates drop. This dynamic creates a cyclical pattern in the industry.

To understand this better, let’s look at two major influences: economic demand and fleet capacity.

Economic Demand

Almost every product sold in the economy moves via full truckload shipping. The retail and industrial sectors are the largest consumers of TL services. As the saying goes, “If you bought it, a truck brought it.â€

When the economy is strong, consumer spending increases, leading to more freight being moved. In contrast, during downturns, spending decreases, reducing freight demand. Over time, freight generation per capita remains relatively stable, though slower population growth can have long-term impacts on overall freight activity.

Freight demand often peaks early in the economic cycle as businesses expand and build inventory, then slows later on. Unlike broader economic recessions, freight cycles tend to be shorter, with upturns lasting about two years and downturns ranging from a few months to two years.

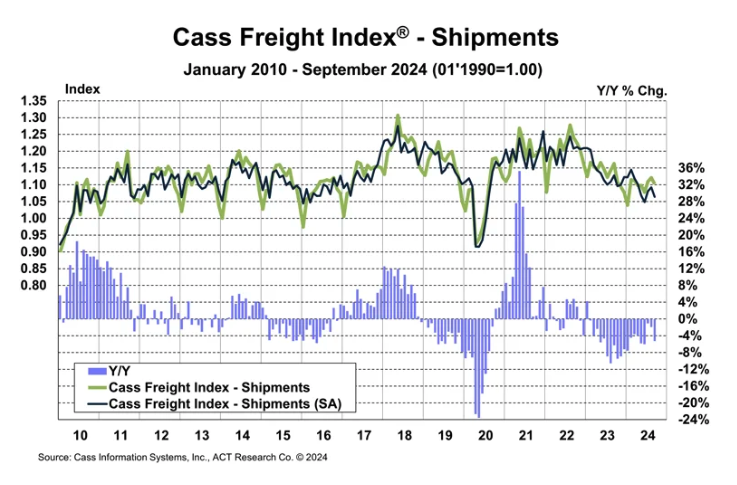

The shipments component of the Cass Freight Index fell 1.7% month-over-month in September after rising 1.0% in August. In seasonally adjusted terms, the index dropped 2.6% m/m. Year-over-year, shipments declined 5.2% in September, following a 1.9% decline in August.

- The index fell 2.6% m/m in SA terms from August to September.

- Shipments declined by 5.2% y/y in September after a 1.9% y/y drop in August.

This decline coincides with continued private fleet insourcing, as Class 8 tractor sales rose in Q3 after supply constraints in Q2.

After increasing by 13% in 2021 and 0.6% in 2022, the index fell 5.5% in 2023. With normal seasonal patterns, the index is expected to drop around 3% year-over-year in October and 4-5% in 2024.

Fleet Capacity

As capacity increases, consumer behavior changes, and inventory levels adjust, which can reduce freight demand. Trucking capacity is not static—vehicles over 11 years old are typically not used in active freight operations, but this varies by fleet.

During tight market conditions, older trucks may return to service due to high demand and limited new equipment. However, when the market softens, less efficient vehicles are often retired due to lower freight rates.

How Do Rates Differ Between Each Type of Freight Trucking?

In a freight recession, like the one we’re currently experiencing, rates across the board are declining. At the bottom of the cycle, the rate gap between flatbed and reefer trailers compared to dry vans tends to widen. As the market begins to recover, dry van rates catch up slightly, but the spread remains wide into the mid-cycle phase before narrowing again in the late cycle.

But are there differences between the types of trucking? Let’s break it down.

Dry Van Trucking

Dry van trucks transport dry cargo in fully enclosed trailers. This is the most common and standardized form of truckload shipping, primarily used for retail goods.

Refrigerated Trucking

Reefer trucks carry temperature-sensitive items like food, pharmaceuticals, and film. Rates in this segment tend to be more stable compared to other types of freight.

Flatbed Trucking

Flatbed trucks haul goods on open platforms without sides or a roof. They are commonly used for industrial freight such as machinery and construction materials. Due to seasonal demand, flatbed rates can be more volatile than those of dry van or reefer.

All types of trucking are interconnected. While the type of freight and trailer may vary, most tractors can handle any of the three main trailer types.

How Do Freight Rates Differ Between Contract and Spot Trucking?

Contract freight rates are fixed agreements between shippers and carriers for a set period. Spot rates, on the other hand, are short-term, on-the-spot prices for shippers without long-term contracts.

While spot rates are often seen as more volatile, both contract and spot markets have their advantages. Businesses often use both to manage unpredictable shipment needs and balance long- and short-term strategies.

Ningbo Hengnuo Hydraulic Drive Co.,Ltd , https://www.hnhydraulic.com